FULL ADVISOR PODCAST NAMED Kitces TOP 5 BEST IN PRACTICE MANAGEMENT!

The financial advisor path to growing your firm: fewer services & higher fees

Hey, it’s Kristin!

Kristin is the former founder of a niched RIA that she grew from zero to six figures of revenue in less than three years, completely from scratch. In 2014 Kristin transitioned full time into training and coaching, where she now helps independent financial advisors build Version 2.0 of their firm while living a fulfilled personal life along the way.

If you’ve had your financial advisory firm for a while, and you know you are not charging enough, or you’re not charging what you want to earn, it’s time to take a hard look at your reality. Do you want to keep doing what you’re doing — overworking for every dollar — or do you want to shift your status quo to a less stressful, more lucrative reality? Likely the latter. While many advisors link growth with attracting new clients, sometimes you can first move the profitability needle with changes to your existing business. The upside is you will make your services more appealing to new clients at the same time. A double win!

The powerful marketing combo to help you earn more profit for your efforts

One of the easiest ways to improve your bottom line is to raise your prices. Another is to revisit your service offering(s) and eliminate low profitability efforts. Put the two together, and not only do you improve your efficiency and earn more for your effort, you’ll likely attract more clients because what you are selling – at what value – is crystal clear. Yet, when it comes to doing either of these, FOMO kicks in. Try to change your service or your fees with existing clients, and just plain FEAR kicks in. Here’s how to think about raising your fees and streamlining your services for both the people who have not yet discovered you and your existing clients. (And yes, if you’re wondering, services and pricing are an essential element in your overall advisor marketing plan

Know your revenue per client (and raise it)

What is the annual revenue per client that you want to earn? Not how much do you earn per client, but how much do you want to earn? This answer informs who your “high value hyper target” is, where one of the criteria is that these people are willing to pay the price you want to earn and find value at that price. For many, when you look at your roster of clients and the average annual fee(s) they pay, that number is often well below the ideal. That’s no surprise. After all, each of your clients is different.

Try the exercise on the top 25% and see if it fits. Still no? Then you have work to do. The higher that percentage of clients who do meet or exceed the ideal, the easier it will be to lop off low-paying or resource-draining clients without regret.

Clarify your service offering

Too often advisors structure their services and pricing from a defensive position. Fear of missing out on opportunity results in a soup-to-nuts list of services and scope-of-work variable pricing that confuses potential clients. And, if advisors do publish their fees, a tiered fee schedule with minimums that may or may not be paid from AUM or may or may not require or include a financial plan adds to the problem. So, too, can many subscription options with clever names, ambiguous descriptions, asterisks and caveats. All of this confusion equals indecision, inaction and lost revenue.

What do you want to offer now?

Chances are that over the years you have “cut and pasted” service options onto your website or prospect sales deck that resulted in an amalgam of confusion. You’ve worked long enough to know where you shine in terms of service and what you really don’t want to do with your time.

When you know the revenue you want to earn per client, streamlining your service offering and pricing becomes much simpler. What can you offer that you and your partners (if applicable) have a desire to provide, that will deliver massive value to the client for the fee you want and an overwhelming sense of fulfillment for you? The clearer you are, the easier it is for a prospect to understand and the more satisfied you will be.

Put service and fees together

As you evaluate your current services, the changes you make could be in service offering, pricing, or both. Here are some real world examples that you may relate to:

- You have three monthly subscription levels that you offer clients and only want to have two (and, if you’re honest with yourself, only one).

- You charge only a monthly subscription fee, and you want to add an upfront fee for the set-up and onboarding phase.

- You offer hourly planning but you don’t want to anymore.

- Your previous minimum fee (either from AUM or planning) was $5,000 and now $8,000 (or higher) feels appropriate.

- You work with people who have at least $500,000 in assets to manage, and you want to change that to $1,000,000.

- You offer tax returns as a stand-alone service, and you envision only bundling it in the full-service offering.

- You do not charge separately for financial planning and now you want to add an upfront financial plan fee.

- You don’t require an investment management relationship, but now you want to require management of assets along with planning.

- Your formula for setting your retainer does not account for home value, and you want to factor it in along with portfolio size and income.

- You charge 1% on the first $1,000,000 you manage and you want to raise that to the first $2,000,000.

What stops advisors from raising fees?

There are myriad reason why advisors waver on increasing fees in general and most certainly for existing clients:

1. “I have to update my ADV.”

Compliance can be an advisor’s #1 excuse to avoid all things marketing. If your new services and pricing are outside the band of pricing and descriptions in your ADV, you will have to change that. And, there will be conversations to hold and paperwork to sign with your current clients. That’s the cost of doing business in our industry. For everything covered in this article, be sure to check with your compliance person to ensure you make the public updates, send communications, and get new agreements in the proper fashion.

2. “I am too afraid to charge what I know the service is really worth.”

Is it imposter syndrome or fear of rejection? Maybe both? It doesn’t matter. When you have clear pricing and service descriptions, you’re giving yourself a crutch to support you as you “get over it” and charge what you’re worth. Help yourself and your prospect by sharing your service overview with the related pricing right on your website and in your prospect communications. Rather than laundry-listing the elements of a financial plan, tie in how each service addresses common fears or aspirations of your target client. More benefits, fewer features. Sharing the value early and often in the courting process helps remove that trepidation of the inevitable fee discussion.

If you price your service after learning more about the individual client, then explain what goes into the fee determination on your site or in communications that prepare the person for the initial meeting. Keep bargaining of fees out of the equation. Have a method for setting fees and stick with them. Clients appreciate knowing they do not have to bargain with you.

Does your pricing method rely on estimating your time? Be careful about trading time for dollars. When you get caught up in pricing based on hours, you’ll either grossly underestimate the amount of time it will take or invite negotiation of scope from the client. You also lose out on any kind of leverage from scale that may come into play.

Remember, you’re going to put the same amount of work in to attract and convert an average or low value client as you will for a high value, hyper-targeted one.

3. “I keep saying yes to people who contact me because some revenue is better than no new revenue.”

Maybe when you first get started this could be the case, but as you grow, you should know better. How many times have you regretted the decision to force fit a client who is out of scope only to feel resentment? Taking on a client who is not a fit is not fair to the client and not fair to you.

Vary levels of service

If you are still working up the courage to stick to your higher fee, or you want to hold an option for people who are early on in building wealth, create tiers of service through unique subscription levels or service packages. Make sure you vary your service level relative to the fee that you charge. Show comparisons of “what’s included” much like you’d see if you sign up for Active Campaign or Mailchimp and make it clear who gets what. This doesn’t mean that you provide “bad service” to people in the lower tier. They simply receive fewer options or alternative access to you or your team. People in a lower tier will naturally aspire to reach a higher level. Those in the higher level will expect the service to match while feeling good about being in the top tier.

To help yourself stop saying yes too often, limit the number of new clients you take each month, quarter or year in your lower tier. This way you can “reserve” the option for only a small percentage of your revenue.

Pre-empt the uncomfortable conversation

Ideally, you will not receive requests from people who are not in the range of service you want to offer. Make it easy for a prospect to understand what service(s) are available, at what fee, what you do not offer, and for whom your service is best (and for whom it is not). Add in minimums or language on your contact page and scheduling link that tells who a good fit client is. (e.g. We work best with clients who have at least $1,000,000. We do not do hourly or project-based planning.)

4. “I can’t seem to attract in people with the right level of assets or a situation complex enough to qualify for the higher fee.”

Tell the right story

Attracting the right people begins with telling the right story through your marketing. Start first with your website messaging (see #2 and #3 above). Next up is changing the content you are creating and sharing. Content marketing works well when you can address the needs of a very specific audience.

When your content speaks only to your high value hyper-targeted client…high value hyper-targeted people notice and appreciate your high value. Talking about “How to start saving for retirement” is not going to help if you have a million dollar minimum for clients. Covering budgeting basics when you want to complex financial puzzles doesn’t jive. Look at your list of clients who match or exceed the fee you want to earn. What are their questions? What problems did you solve for them? Go deep on those issues in your content. Don’t try to appeal to everyone. You won’t catch the eye of the people you serve best.

Location, location, location

Be sure you are sharing your content in the places where your audience spends time. Many advisors go right to “which social media platforms should we be on?” which is one part of the mix. For a much bigger impact, however, seek out people, platforms, organizations and publications who already have a loyal audience who matches your ideal client. You’ll get the most bang for your content buck. What does this look like? You are interviewed on a podcast, share a guest blog post, host a joint webinar, speak at conference, or get a pitch picked up by an authoritative site.

People refer people like themselves

If the majority of your clients do not fit your high value hyper-target persona, then you are unlikely to get referrals who fit the bill. As you shift your client paradigm, you’ll begin to see the trickle down referral effect.

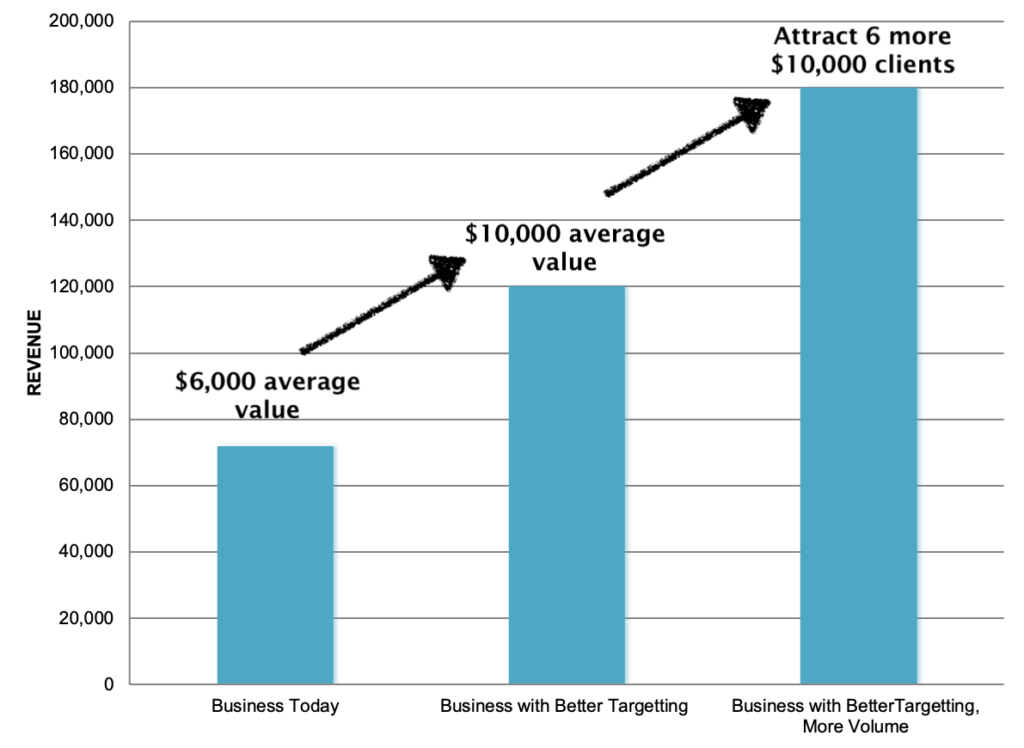

Better targeting attracts more high value clients without coming close to doubling your effort. In this hypothetical example, when you increase your fee and service to serve a $10,000 client rather than a $6,000 client, and referrals match the new persona rather than the old, you can see your client base is 50% larger yet your revenue has grown by 150%.

If current clients are sending people who do not fit the bill, help that person find the right advisor. You can let your existing client know that while you weren’t fit, you found someone who is and you were happy to help. [For more on how to talk with your clients about referrals, check out Julie Littlechild’s and Stephen Wershing’s podcast Becoming Referable].

5. “I have clients who trusted me early on, and I want to reward their loyalty by keeping their fees low.”

Reward their loyalty by continuing to provide a service packed with value backed by a strong personal relationship. If they’ve been with you a while, they know what you bring to the table, and you have the opportunity to reinforce that when you communicate your new fees. If you have a substantial increase in your fees, you can step up your existing clients in increments over time knowing they may still come in under your market price. As long as you enjoy working with them, don’t worry if they’re not exactly on par. Get them close enough. (Scroll down to the next section for more on how to make this shift).

6. “I have clients who joined me early, and I feel stuck with them at these low levels…even though I wouldn’t work with them today and wouldn’t miss them if they left.”

Cut the cord. You can either let them know that you’ve changed your business and will no longer be able to service them (please find resources for them in advance!) or increase their fee to the market price which will likely result in their exit. Beware that some may choose to stay at the higher fee, and if you wouldn’t work with them today, why continue? For an excellent example of how to communicate with clients who you no longer want to work with, download Matthew Jarvis’ example that he shared on the Financial Advisor Success podcast.

How to enact your advisory service and fee changes

Once you decide what your service offering(s) and new pricing are, make the changes to your website that reflect what you want to sell moving forward. If you’ve only gotten as far as “I know I no longer want to offer this,” take it off your services page on your website. Why continue to advertise something you do not enjoy doing?

When you’re on calls with prospects, you can “test drive” your new service descriptions and fees, even if you do not yet have them on your website. This can be be helpful if you’re wavering between fee options, aren’t sure how to explain a service (hint: listen to the questions people ask about it), or just want to see if there’s interest in a new feature. This active research will help you finetune your offering.

Compliance caveat: please check with your compliance officer to make sure you communicate changes properly.

How to increase client fees

Give plenty of notice. One quarter in advance should be your rule of thumb. No one likes fee increases, but time to process softens the blow. You have many options to communicate the changes:*

- Meetings: If you have a scheduled meeting with your clients in the months preceding the change, discuss it then in person (or on zoom). Add it as an agenda item to keep it ‘matter of fact.’ Send the agenda in advance and you’ll have less stress about it.

- Send an email or letter and start by thanking them for being a valued client. State the facts without excuse. Give the new rates, the timing, and let them know any action they need to take (e.g. you will receive a new agreement to sign). If their fee is still below market, this is a time to let them know the special place they hold in your business. One example of how to do this weaves in referral requests and the high value hyper target all-in-one paragraph:

I am fortunate to work with many clients who are transitioning out of business ownership to help with comprehensive financial planning and investment management. I always appreciate referrals from my current clients. If you do send someone my way, please know that my new client rate is higher than my long-standing client rate. All new clients pay at least $x,000 or higher (depending on their situation and service needs).

- Give your client a call. This may be the hardest option since you may catch them off guard. If ad hoc calls are part of your relationship, this can work well since the casual nature of the outreach diffuses the topic tension. You’ll follow up with written notice, but you’ve already conveyed the message in the manner you’d usually communicate.

*Compliance caveat, again: please check with your compliance officer to make sure you communicate changes properly.

Feel good about your business

When you streamline your service offering to align with what you enjoy most, for the people you enjoy serving, you can amplify the everyday fulfillment you get from running your business. Charge fees that align with the value you offer, and you not only improve the profitability of your business and can invest in delivering even more value to your clients, you can take care of yourself, too. This can show up in many ways, including:

- saving for your own retirement,

- reducing your stress,

- freeing up time,

- having a lifestyle that suits you, and

- giving back to your community in ways that matter to you.

You do important work and help people every day. You’ve worked hard to get where you are today. You deserve to reap the benefits, too!

Hey, it’s Kristin!

Kristin is a CERTIFIED FINANCIAL PLANNER™ professional. Managing her own firm, she grew it from zero to six figures in less than three years, completely from scratch. In 2014 Kristin transitioned full time into training and coaching, where she now helps independent financial advisors to grow their firms.

Find fulfillment faster!

Get the latest tips, articles, podcast episodes and more

from Full Advisor coaching. Sign up for our mailing list today.

Full Advisor Coaching | Designed by Blush Cactus

©2026 Broderick Street Partners, LLC DBA Full Advisor Coaching