FULL ADVISOR PODCAST NAMED Kitces TOP 5 BEST IN PRACTICE MANAGEMENT!

Niche Marketing for Financial Advisors: How Financial Planners Need to Market Now

Hey, it’s Kristin!

Kristin is the former founder of a niched RIA that she grew from zero to six figures of revenue in less than three years, completely from scratch. In 2014 Kristin transitioned full time into training and coaching, where she now helps independent financial advisors build Version 2.0 of their firm while living a fulfilled personal life along the way.

For the past decade I’ve listened as financial advisers tell me they are afraid if they pick a niche and speak to one target audience, they will lose out on opportunities.

Financial planners get nervous about pigeonholing themselves, so they keep their options open, and do not commit to the type of client they serve. Alas, they wonder why they are still in the same place—working too hard for less return than they expected—after all of these years.

If you’ve been in business awhile and you’re serious about increasing the revenue in your financial advisory practice, decreasing the effort you invest, and discovering higher fulfillment overall, you need to attract better-suited people to your practice.

Don’t worry, I won’t ask you to select your niche, and let you get away with “women in transition” or “men 5-10 years from retirement.” No, not if you want to move the needle.

You are going to pick your high value hyper target – your niche. Here’s how:

1. First, define the client you do not want.

If you’ve been in business a while, you know specific people who come to mind, “I do not want another (insert name here).”

You will be surprised what the action of writing down a description of the client who drives you crazy, who irritates or angers you, does for your clarity. Commit to yourself that these are people who will hear only “no” from you. Write down the description beginning with “I will under no circumstances work with …” With this out of the way, you can now…

2. Name the client who will pay the fee you desire.

Sounds easy enough, but advisers get tripped up here because more than one option may come to mind. If you answered the 5 clarity questions I offered in an earlier post, I want you to zero in on question #2: What is the annual revenue per client that you want to earn?

Consider all of your clients past and present. Who is the one who appreciates the value of your service at the fee you want to earn?

What type of person stands out when you think, “Who do I want to clone?”

If you are stuck here thinking, “I don’t have those people, but I know I’ve been undervaluing my work,” or you can’t name an existing client, then write a description that considers the opposite traits of your Don’t Want list. Who is the flip of your “no” client?

3. Draft a 5-level detailed description of your ideal client:

Five levels?! Yes. You want to be able to pinpoint exactly who this person is, without doubt or question. As you dive deeper, slice and dice audience attributes and attitudes to get even more exact.

I will share the example I used for my (former) financial planning practice where I set up to work with younger people who were in the accumulation stage of life, like I was. That’s a large group of people, so to take this 5 levels, I narrowed down my choices to find my high value hyper target:

- Level 1: Who within Accumulators do I want to help? New Parents.

- Level 2: Where are these new parents? San Francisco.

- Level 3: Of the San Francisco-dwellers, do I want to target men or women?

- Level 4: Of these San Francisco-dwelling women, for what stage of new parenting will I focus? Expecting her first child.

- Level 5: What else is important to these San Francisco new parent women who are expecting their first child? Their post-baby career / parenting balance. I chose to work with women who were unsure what to do after the birth and sought guidance.

Rather than simply capturing my target audience as “new parents, “ when I went out to find marketing channels through which to share content, advertise, and host training, I looked for opportunities to share with this woman: a San Francisco dwelling woman expecting her first child whose career has been important to her but she is unsure what she will do after birth. This specificity opened up countless options for me and served as a guide for the content I developed.

“One of the big fears is that once you pick this target, you are stuck here. Not so.”

After a while, I expanded beyond San Francisco into Bay Area suburbs including Palo Alto, Menlo Park, and Mill Valley, bringing in other advisors to work with me. I also shifted my target to the woman expecting her second child because she appreciated the value of the work more, was more prepared to implement, and had a sense of where career fit in her overall life plan.

With a focus to the client who finds value in your desired annual fee, described down to 5-levels of specificity, you now know the client you want. And, in all of your marketing going forward, this is the ONLY person with whom you are going to speak.

I call this high value hyper-targeting.

Let’s take a look at the payoff for this kind of keen focus.

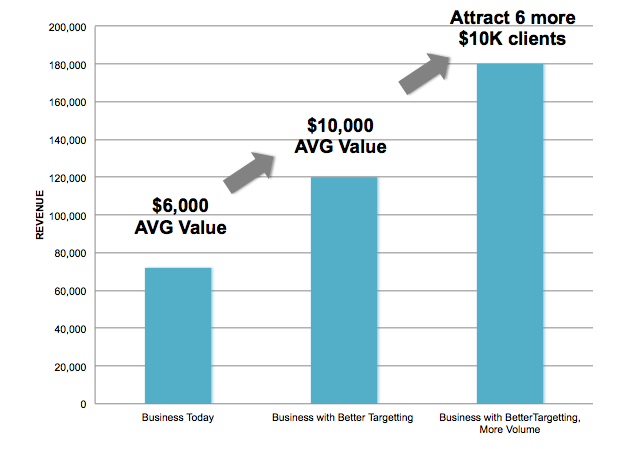

In this example, let’s assume your average client revenue per year is $6000 right now.

Over the next 12 months you bring in 12 new clients who pay you this amount. That’s $72,000 in new revenue.

Now, let’s assume that you zero in on attracting the type of client who fits your desired revenue of $10,000.

If you focus your marketing and you speak only to your high value, hyper-targeted client, high value, hyper-targeted people notice and appreciate your high value. You attract in 12 new clients, but they pay you $10,000, or $120,000 in new revenue. You have increased your revenue simply by honing your target and messaging.

When you share your high value hyper-targeted content, more of these high value, hyper-targeted clients clamor to work with you. As the new high value, hyper-targeted clients come in, they tell their high value, hyper-targeted friends who are just like them. Your expertise is now well known among this group of similar folks.

Let’s say this results in 6 more clients who are also the high value, hyper-targeted person you desire. With more volume, you added another $60,000 to your revenue.

In this example, your client base has grown, your revenue has grown, but you haven’t come close to doubling your effort. You are making powerful shifts with hyper-targeted marketing. Your client base is 50% larger yet your revenue has grown 150%.

Find your niche – the high value, hyper-targeted clients and start talking directly to them. Wait until you see how much easier your marketing becomes.

Hey, it’s Kristin!

Kristin is a CERTIFIED FINANCIAL PLANNER™ professional. Managing her own firm, she grew it from zero to six figures in less than three years, completely from scratch. In 2014 Kristin transitioned full time into training and coaching, where she now helps independent financial advisors to grow their firms.

Find fulfillment faster!

Get the latest tips, articles, podcast episodes and more

from Full Advisor coaching. Sign up for our mailing list today.

Full Advisor Coaching | Designed by Blush Cactus

©2026 Broderick Street Partners, LLC DBA Full Advisor Coaching